The supreme accomplishment is to blur the line between work and play.

—Arnold J. Toynbee

I agree with that, and doing our income taxes every year is great chance for me to practice.

How can I get this done and enjoy the process?

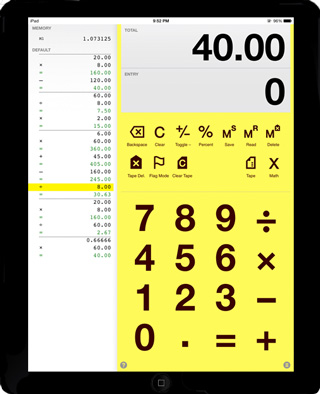

We’ve simplified things a lot, which helped enormously, and as I’ve mentioned before, I love my Digits app on my iPad.

As the creators of the app say

Digits combines the edit-ability of a spreadsheet with the simplicity of calculator. Dare we say it? Digits is a calculator a human can love.

Well, maybe not all humans, maybe just us geeks. But I for one am grateful. 🙂

Anyway, we finished our taxes last week and sent them off Monday. That was a great feeling too.

April 12, 2016

We knew that we were getting a little refund this year, so we hurried and did our taxes, and it really was and IS a good feeling to have them done for another year!

Yes!!

Like Kim, I do my taxes immediately too!

I use Turbo Tax online. It’s free because I’m below the income cut off.

It’s very easy. You just plug in the answers, which for me is pretty cut and dry.

I did it right away because I wanted to see how bad Obamacare would hurt me this year.

🙁

I prefer to know bad news asap, so I can deal with it rather than sit and fret how bad it’s gonna be.

😉

I’m with you. I like to face these things right away rather than have them nag at me.

So you think Obamacare hurts rather than helps?

We have time to file our returns and as you know, I hire a Professional to do my Income Tax Returns. My last year’s refund has been cleared but is yet to be credited to my account but for this year there will be neither any tax to be paid nor any refund for me.

That’s interesting that it takes so long to get your refund They’re reasonably quick here. That’s great that you don’t need to pay more taxes or get a refund this year. That simplifies things a lot. 🙂

I waited longer than ever this year, but our records are finally in the hands of the accountant who does our taxes. I used to do them, but the companies offering the few investments I have seem to delay their notices until the very last minute—I just can’t stand the stress! So off they go, and it’s a good thing too..I can use my time doing things that are a lot more satisfying!

I thought the deadline for companies sending out the forms was February 16. Shortly before that I was noticing which forms we hadn’t received yet and Andy said I was jumping the gun. They did come in time, except from our local bank, and Andy went over and got it himself. My interest was because last year it took me a month trying to get something straightened out, and I wanted to know I had plenty of time just in case. It went swimmingly this year, and hopefully in future years.

mine is so simple I use the 1040A on paper.

and even at that… I only just did it a few weeks ago!

I know they want all of us paper dinosaurs to do it online.

and eventually I really WILL!

but each year I go to the library and get the old familiar form.

maybe next year… i’ll do turbo tax too. they said it would be free for me too! so why do I fight anything that’s FREE??? LOLOL!

That is a big switch. We’ve only sent ours in electronically for a couple of years now. The nice thing is the state and feds tell you right away if they’ve been accepted. That’s a comfort with all the news about identity theft. It also saves Andy a trip to the post office and getting proof that we mailed them.

In response to whether I think Obamacare hurts rather than helps…

OMG! I HATE it!

Here’s why.

Before Obamacare I could go to a walk-in free clinic.

The only time I used it was when I couldn’t get a deep breath and thought someone was on my chest and I felt dizzy and etc. They had me come over and they did some blood tests and found that I was probably having a panic attack and also that I had high cholesterol and they put me on a generic statin that was like $9. (but i went off of it because of side effects) and then the county had vouchers for free yearly mammograms and paps. Other than that, I never went to the doctor.

NOW I have to pay a large (to me) monthly insurance premium and have a deductible of $6000. Yep. I get the exams free and the mammos but if I need any medications or treatments I have to pay out of pocket until I reach $6000. and then afterwards I would still have to pay a %.

If I don’t sign up for it, I’ll get hit with a fine.

Last year I paid monthly and never went to a doctor.

This year I didn’t sign up and I’m not paying the monthly premium but they say I will be hit with a $700. penalty fine on next years taxes.

$700. is a lot of money but it’s a lot less than the monthly premiums when you add it up.

Yep. If you are very very poor, it probably is a good thing.

and if you got a little bit of extra cash, it’s probably a good thing.

but if you live paycheck to paycheck, it makes your life a lot harder.

So, I’m living on the edge I guess. That’s why I’m trying to eat better and get healthier. Hopefully I won’t have an accident of sorts.

But actually, I hate hospitals and modern medicine so much that I probably wouldn’t go to one unless I was unconscious and they wheeled me in there.

In that case…hmm, I need to sign a dnr, now that i’m talking about this…

but that’s what I think of obamacare.

I’m sorry you’re the one caught by it. That sucks!

Andy and I have each signed our DNR forms and our doctor and the local hospital have copies. One of the main reasons I exercise regularly and eat well is I want to stay clear of hospitals and medical care as much as possible. We’re kindred spirits there.

well I currently do not do taxes – due to the financial situation I am in…

but just let me say, is that I regularly have to fill in a form with maybe 15 boxes that need something in them, and then I have to write a bit of story in another huge box…

Hopefully the story you have to write isn’t too much of a pain.